The following problem in differential equations has a very practical application for anyone who has either (1) taken out a loan to buy a house or a car or (2) is trying to pay off credit card debt. To my surprise, most math majors haven’t thought through the obvious applications of exponential functions as a means of engaging their future students, even though it is directly pertinent to their lives (both the students’ and the teachers’).

You have a balance of $2,000 on your credit card. Interest is compounded continuously with a rate of growth of 25% per year. If you pay the minimum amount of $50 per month (or $600 per year), how long will it take for the balance to be paid?

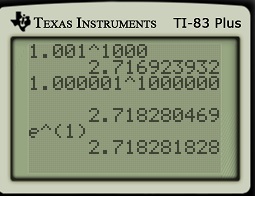

In previous posts, I approached this problem using differential equations. There’s another way to approach this problem that avoids using calculus that, hypothetically, is within the grasp of talented Precalculus students. Instead of treating this problem as a differential equation, we instead treat it as a first-order difference equation (also called a recurrence relation):

The idea is that the amount owed is multiplied by a factor (which is greater than 1), and from this product the amount paid is deducted. With this approach — and unlike the approach using calculus — the payment period would be each month and not per year. Therefore, we can write

Notice that the meaning of the 25% has changed somewhat… it’s no longer the relative rate of growth, as the 25% has been equally divided for the 12 months.

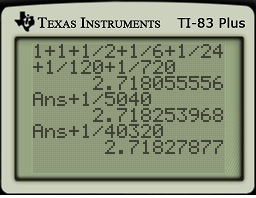

In yesterday’s post, I demonstrated that the solution of this recurrence relation is

.

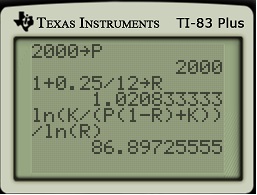

Let’s now study when the credit card debt will actually reach $0. To do this, we see and solve for

:

That’s certainly a mouthful. However, this calculation should be accessible to a talented student in Precalculus.

Let’s try it out for ,

, and

:

Remembering that each compounding period is one month long, this corresponds to years, which is nearly equal to the value of

years when we solved this problem using differential equations under the assumption of continuous compound interest (as opposed to interest that’s compoounded monthly).

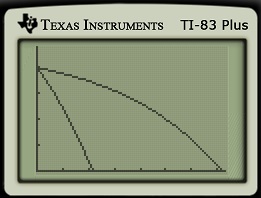

2. We have the limits

2. We have the limits