Source: https://xkcd.com/2768

See also my series on the number e.

Explaining the "whys" of mathematics

In my capstone class for future secondary math teachers, I ask my students to come up with ideas for engaging their students with different topics in the secondary mathematics curriculum. In other words, the point of the assignment was not to devise a full-blown lesson plan on this topic. Instead, I asked my students to think about three different ways of getting their students interested in the topic in the first place.

I plan to share some of the best of these ideas on this blog (after asking my students’ permission, of course).

This student submission comes from my former student Lydia Rios. Her topic, from Precalculus: compound interest.

How did people’s conception of this topic change over time?

While this concept is tied with business which is something that started rapidly changing in the early nineteen hundreds, we have understand that there is an accrued interest on loans long before then. People would loan out seeds or cattle and the interest would be paid after a harvest or with the young of the cattle. Of course now we use this concept mathematically but the concept still holds. We understand that there is a base fee and you must return that fee along with a little more. We then started using this with loose change and then as our currency changed from the gold standard we adapted to a new understanding of compound interest. Today we use the equation , where

is the amount accumulated,

is the principal,

is interest rate,

is the compound period and

is the number of periods.

Compound Interest Is Responsible for Modern Civilization (businessinsider.com)

What are the contributions of various cultures to this topic?

We have all experienced trade over the years. Native Americans would trade corn for other goods and offered payment plus interest with their corn harvest. The Silks Roads was a network of trading routes where China and other countries would trade textiles and other materials. They established the concept of payment and interest for purchases. Banks in America and other countries also have a set principal and a interest, whether this be in reference to your savings account or the billed interest on your credit card purchases. Even the invention of cars played a part on this and how our interest can decrease with the deterioration of the car. Over the years your interest payment can go down as the worth of the car goes down.

How have different cultures throughout time used this topic in their society?

Native Americans used compound interest to create trade deals a maintain some status of peace. China had their silk roads where they turned a profit and tried to maintain a sense of livelihood. For some cultures this was their only source of income, if they didn’t’ make some sort of trade then they had nothing to bring home. For others, such as the Native Americans, the trade itself was to protect their lives and the interest was something they owed. We can even see reference to this with the trade markets in Disney’s Aladdin, Aladdin cannot make a trade as he is a peasant but we see other village people making trades and we grasp the concept of worth from each object.

In my capstone class for future secondary math teachers, I ask my students to come up with ideas for engaging their students with different topics in the secondary mathematics curriculum. In other words, the point of the assignment was not to devise a full-blown lesson plan on this topic. Instead, I asked my students to think about three different ways of getting their students interested in the topic in the first place.

I plan to share some of the best of these ideas on this blog (after asking my students’ permission, of course).

This student submission comes from my former student Mason Maynard. His topic, from Precalculus: compound interest.

What interesting (i.e., uncontrived) word problems using this topic can your students do now? (You may find resources such as http://www.spacemath.nasa.gov to be very helpful in this regard; feel free to suggest others.)

These word problems are some of the basic compound interest problems that your students learn how to do where you just plug in the correct values for their corresponding variables.

These are the types of problems that get more difficult for the students. You want them to use compound interest to solve but then they must incorporate logs into their solutions because they are looking for time instead of interest.

How does this topic extend what your students should have learned in previous courses?

With compound interest, students first learn about the simple interest formula. The only main difference is that you start to include exponents with compound interests. Then when you introduce your students to compound interest, you start to get into some more complicated problems. After they learn about compound interest and its basic problems, then you transition into logs with your students. This is used in compound interest and instead of just looking for the interest that will be accumulated after a specific amount of time, you then shift the variable around that you are looking for. The most coming type of problem that refers to this is they give you all of the information except for the amount time it takes to get a certain amount of interest. The last thing that leads up to compound interest in Calculus is when you transition from calculating the amount of interested over specific time intervals and a specific amount of times you compound it to calculating it with compounding it continuously over a specific time interval.

How have different cultures throughout time used this topic in their society?

Interest is something you have to pay on a load. Depending on what side you are and how thinks go, you are either getting some more money back that what you invested or you are paying off a massive debt. Some think that the idea behind charging loans on interest came from the early days of neighbors loaning there cattle to one another. What is really unique about this is that the words in the Egyptian, ancient Greek and Sumerian languages is connected to cattle and their offspring. This leads some to believe that interest came about due to the natural increase of the herd that occurred when you loaned out your cattle.

The first evidence that comes of a compound interest problem dates back to 2000-1700 B.C. in Babylon. A clay tablet was found and the unique thing is that the interest rate use to solve it was not written. Some researchers assume that the rate was 20% due to that mainly all the other compound interest problems dating back closer to this used it. What is really crazy is that 20% worked to solve the problem. The only thing that was wrong was that the time was corresponding to the Babylon calendar of 360 days instead of our 365 days.

In 50 B.C. Cicero writes to a friend in Rome. The letter tells that he would not normally recognize more than 12 percent interest on a loan, even though a decree was passed which required money lenders to charge no more than 12 percent. Cicero would then write a few days later that they will pay back the loan in 6 years will 12 percent interest and more money will be added each year.

Resources:

Compound Interest History:

Word Problems:

https://www.basic-mathematics.com/compound-interest-word-problems.html

In my capstone class for future secondary math teachers, I ask my students to come up with ideas for engaging their students with different topics in the secondary mathematics curriculum. In other words, the point of the assignment was not to devise a full-blown lesson plan on this topic. Instead, I asked my students to think about three different ways of getting their students interested in the topic in the first place.

I plan to share some of the best of these ideas on this blog (after asking my students’ permission, of course).

This student submission comes from my former student Diana Calderon. Her topic, from Precalculus: introducing the number .

How could you as a teacher create an activity or project that involves your topic?

– A project that I would want my students to work on that would introduce the number would be with having a weeklong project, assuming it is a block schedule, to allow the students to think about compound interest. the reason why we would use the compound interest formula to show

is because, “It turns out that compounding weekly barely yields any more money than compounding monthly and at higher values of

, it gets closer and closer to what we recognize as the number

” The project would be about buying a car, the students would get to choose the car that they want, research multiple car dealerships, and they must figure out the calculations for compound interest in 24 months, 36 months, 48 months, 60 months and 72 months. For their final product they must have a picture/drawing of the car they chose to purchase, as well as choose the number of months they would like to finance for and the dealership they will purchase form. Finally, they must turn in a separate sheet with the calculations for the other months of finance they did not choose and why they chose not to choose them.

What interesting things can you say about the people who contributed to the discovery and/or the development of this topic?

– The number or better known as Euler’s number is a very important number in mathematics. Leonhard Euler was one of the greatest Swiss mathematicians from the 18th century. Although Euler was born in Switzerland, he spent much of his time in Russia and in Berlin. Euler’s father was great friends with Johan Bernoulli, who then became one of the most influential people in Euler’s life. Euler was also one who contributed to “ the mathematical notation in use today, such as the notation to describe a function and the modern notation for the trigonometric functions”. Not only did Euler contribute to math, “He is also widely remembered for his contributions in mechanics, fluid dynamics, optics, astronomy, and music.” Euler was such an amazing mathematician that other mathematicians talked very highly of him such as Pierre-Simon Laplace who expressed how Euler is important in mathematics, “‘Read Euler, read Euler, he is master of us all’”

How can technology (YouTube, Khan Academy [khanacademy.org], Vi Hart, Geometers Sketchpad, graphing calculators, etc.) be used to effectively engage students with this topic?

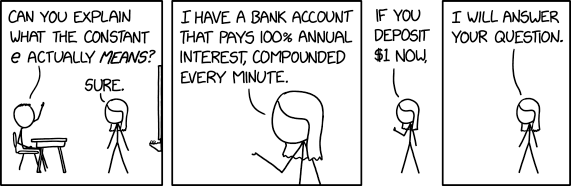

– This video would be great to show to students to see how the number e is applied in different ways. The video starts off by talking about how we get , “mathematically it is just what you get when you calculate 1 + (1/1000000)^1000000= 2.718 ≈ e and as the number gets bigger, you get Euler’s number, e=lim n→∞ f(n) (1+1/n)^n.” This is a really good video to show because the YouTuber talks about how when he was learning about the number e, he thought that it would never show up and then later realized that the better question was, when doesn’t it show up? He then proceeds to talk about how if you’re in high school then you start talking about it when it comes to compound interest, he then proceeds to give an example, “imagine you put $1 in a bank that pays out 100% interest per year, that means after one year you’ll have two dollars but that’s only if th interest compounds once a year. If instead it compounds twice a year you get 50% after 6 months and another 50% after 6 more months.”, and so on, he explains up to daily and compounding every second, nanosecond and so on, the amount in that persons bank would become $e ($2.1718). He then gives a real-world examples of probability with the number e. I would stop this video at 3:09 because that would give enough insight to the students about other applications of the number e and why it useful for them to learn it and not just think about it as a button in their calculator.

Citations:

– https://brilliant.org/wiki/the-discovery-of-the-number-e/

– https://en.wikipedia.org/wiki/Contributions_of_Leonhard_Euler_to_mathematics

– http://www.softschools.com/facts/scientists/leonhard_euler_facts/826/

– https://www.youtube.com/watch?v=AAir4vcxRPU

In my capstone class for future secondary math teachers, I ask my students to come up with ideas for engaging their students with different topics in the secondary mathematics curriculum. In other words, the point of the assignment was not to devise a full-blown lesson plan on this topic. Instead, I asked my students to think about three different ways of getting their students interested in the topic in the first place.

I plan to share some of the best of these ideas on this blog (after asking my students’ permission, of course).

This student submission comes from my former student Julie Thompson. Her topic, from Precalculus: introducing the number .

What interesting word problems using this topic can your students do now?

I found a very interesting word problem involving the number e and derangements. A derangement is a permutation of a set in which no element is in its original place. The word problem I found is as follows:

“At the bohemian jazz parties frequented by aficionados of the number e, the espresso flows freely, and at the end of the evening, party-goers are just as likely to go home in someone else’s overcoat as they are in their own. After such a party, what are the chances that at least one person goes home wearing the right coat?”

To start off, we need to find out how many permutations, or how many combinations of ways the coats can be put on at random when guests leave the party. The problem asks us to identify the chance that at least one person IS wearing the right coat. In other words, we need to delete all the combinations in which nobody grabbed the correct coat. These are the derangements. Interestingly, when you divide the number of permutations by the number of derangements, you get a number extremely close to the value of e. And the ratio is always so.

Looking at a numerical example with 10 guests, the number of ways 10 people can pick up 10 coats (permutations) is 3628800, and the number of ways nobody would pick up the right coat is 1334961. Dividing, 3628800/1334961= 2.71828, which is extremely close to e. Therefore, the chance of nobody getting the right coat is about 1 in e. How interesting. I feel like this word problem would really interest students!

How was this topic adopted by the mathematical community?

The number e was not discovered as ‘naturally’ as you may think. Mathematicians came close to discovering e in their calculations many times in the 17th century but thought it was just a random number without any real significance. The first person to calculate e is not documented, but historians believe it to not even be a mathematician, but a banker or trader. Why is this?

The number e is very fundamental to a financial process that took off in the 17th century. “The number e lies at the foundations of one of the most fundamental processes of finance: compound interest.” Mathematicians, including Jacob Bernoulli, would later go on to define:

.

“This is why the number e appears so often in modeling the exponential growth or decay of everything from bacteria to radioactivity.” This fact was adopted by the mathematical community and many mathematicians started collaborating and making many more discoveries on the number e, such as Euler, who estimated e correctly to 18 decimal places, gave the continued fraction expansion of e, and made a connection between e and the sine and cosine functions. The number e is one of the most beautiful and powerful number in all of mathematics and the use of it was adopted into mathematics most likely by a banker…how interesting.

How can technology be used to effectively engage students with this topic?

Any graphing technology, such as a TI calculator, Mathematica, MatLab, Desmos, etc., are great tools to use in order to engage students when discovering the number e. For instance, to convince students that the above limit is true,

,

I can have them graph the function for themselves and actually see that the function approaches the number e as x gets very large. Similarly, I can simulate numbers of e on a computer program with the expansion 1 + 1/1! + 1/2! + 1/3! + … to show the sum getting closer and closer to the value of e the more terms I add. I believe this will be really engaging because the expansion for the number e and the limit for e look like they have nothing to do with e at first glance. To make the connection between them graphically would be somewhat magical to students and hopefully make them curious for more.

References:

http://wmueller.com/precalculus/e/e6.html (this is word problem from A1)

https://brilliant.org/wiki/the-discovery-of-the-number-e/

http://mathworld.wolfram.com/e.html

http://www-history.mcs.st-and.ac.uk/HistTopics/e.html

In my capstone class for future secondary math teachers, I ask my students to come up with ideas for engaging their students with different topics in the secondary mathematics curriculum. In other words, the point of the assignment was not to devise a full-blown lesson plan on this topic. Instead, I asked my students to think about three different ways of getting their students interested in the topic in the first place.

I plan to share some of the best of these ideas on this blog (after asking my students’ permission, of course).

This student submission comes from my former student J. R. Calvillo. His topic, from Precalculus: compound interest.

How was this topic adopted by the mathematical community?

The mathematical community adopted the concept of compound interest very well. Albert Einstein was one of if not the biggest mathematician who adopted this policy of compound interest very well. His most notable quote on the topic is, “Compound interest is the eighth wonder of the world. He who understand it, earns it… He who doesn’t… pays it.” (Albert Einstein) Compound interest has expanded even from the mathematical community and spread to banks, and how they decide to give out interest on deposits or loans. The concept of compound interest has truly been one of the most well received concepts in the mathematical community, so much so that it even spread outside of that community into the business world. Where it then changed how businesses and banks looked at interest.

How could you as a teacher create an activity or project that involves your topic?

Compound interest is a very important and very relatable topic for teachers to be able to relate real world examples to. With that, I believe it is very important to make compound interest relatable to the real world uses that students’ will one day see when they get older. To begin the activity, each student will receive $2,000. That $2,000 will be put in the bank and the bank has agreed to add interest. The bank decided to give them the option on how they want that interest compounded; daily, monthly, quarterly or yearly. At the end we will group together the students’ who wanted to compound their interest similarly. Each group will get to explain why they chose how often it will be compounded, then will get the opportunity to solve how much it will grow after 2 years, 4 years and 20 years. This will then allow the students to see the differences and similarities between the different options that the bank provided, and which option will earn you the most money.

How can this topic be used in your students’ future courses in mathematics or science?

Compound interest is a topic that will originally get introduced in a pre-calculus class, however, if any students’ go onto take classes such as statistics or any other business related math, it will contain material on compound interest. It is used as such a big role in the business world that getting a true understanding how it works and the reasoning behind why it works is crucial from the earliest class that we see it in. In later classes it can be touched on more so, especially reaching the ways that it is beneficial to use it or the ways that it may hurt to use it. Either way it is a concept that will come up again whether you see it in the classroom, or in real life. Compound interest is one of if not the most relatable topic to the outside world with all of its applications to loans and how it is used in banks. Getting the fundamental concepts early is a crucial aspect to understanding its deeper usage in other courses.

Resources:

Compound interest – Albert Einstein. (n.d.). Retrieved from https://quotesonfinance.com/quote/79/albert-einstein-compound-interest

In my capstone class for future secondary math teachers, I ask my students to come up with ideas for engaging their students with different topics in the secondary mathematics curriculum. In other words, the point of the assignment was not to devise a full-blown lesson plan on this topic. Instead, I asked my students to think about three different ways of getting their students interested in the topic in the first place.

I plan to share some of the best of these ideas on this blog (after asking my students’ permission, of course).

This student submission comes from my former student Deanna Cravens. Her topic, from Precalculus: introducing the number .

How was this topic adopted by the mathematical community?

The number e is a relatively newer irrational number if compared to pi. However, it first made its appearance very subtly in 1618. Napier was working on a table of natural logarithms, however it was not noted that the base was e. There were a few other appearances of e but mathematicians had not truly made a connection to it. Eventually in 1683, Jacob Bernoulli was looking at a business application dealing with continuously compounded interest and recognized that the log function and the exponential function were inverses. In 1690, a letter was written by Leibniz and e officially had a name, except it was called ‘b’ at the time. As it comes to no surprise, Euler had his hand in discovering e. He published Introductio in Analysin infinitorum in 1748 where he showed that e is the limit of . Now Euler did not explicitly prove that e is irrational, however most people accepted it at that point, but it was indeed later proven.

How could you as a teacher create an activity or project that involves your topic?

Where does the number e come from? Well, the answer is a business application dealing with continuously compounded interest. However, students in a pre-calculus class can easily discover the number e without having to use the calculus behind it. Simply give students this short activity at the beginning of class.

One of the good things about this activity is that it gives a brief snippet of the history of e before students begin to calculate it. Then, students can easily use a calculator and plug in the listed values in the table into the equation . As the numbers get increasingly large, students will notice that they will all appear to be getting closer to 2.718… which is now known as the number e. As a teacher it is important to note that e is like pi, it is an irrational number that goes on forever and doesn’t have any sort of repeating pattern, yet it is extremely important in mathematics.

How can technology (YouTube, Khan Academy [khanacademy.org], Vi Hart, Geometers Sketchpad, graphing calculators, etc.) be used to effectively engage students with this topic?

This video would be excellent to show students who are asking, “why is e so important or where does it come from?” The video starts out by stating what e is approximately equal to. Then it gives a brief history about e and talks about compounded interest. It does a great job at explaining compounded interest. It is executed in a way where pre-calculus students can easily understand the concept. It also uses good visual cues to show how it would work. Next it lists several applications of e. These applications include: statistics through the normal curve, biology by modeling population growth, and physics by the exponential decay of a radioactive material. Overall, it does a great job showing the importance of e in real world applications. Thus, showing the importance of e to a pre-calculus students.

References:

1. http://www.classzone.com/eservices/home/pdf/student/LA208CAD.pdf

2. http://www-history.mcs.st-and.ac.uk/HistTopics/e.html

3. https://www.youtube.com/watch?v=R0oUeLQIbIk

In my capstone class for future secondary math teachers, I ask my students to come up with ideas for engaging their students with different topics in the secondary mathematics curriculum. In other words, the point of the assignment was not to devise a full-blown lesson plan on this topic. Instead, I asked my students to think about three different ways of getting their students interested in the topic in the first place.

I plan to share some of the best of these ideas on this blog (after asking my students’ permission, of course).

This student submission comes from my former student Michelle Contreras. Her topic, from Precalculus: compound interest.

How could you as a teacher create an activity or project that involves your topic?

Compound interest can be something difficult to understand sometimes. That’s why before I even start refreshing my future pre-calculus class about the general formulas they are going to be working with, I would like to start the lesson with a “game”/ activity. Starting class with this activity can be beneficial in the long run because they are going to be more willing to pay attention the rest of class. The game is my own little twist of what we know is the marshmallow game. In the marshmallow game the teacher hands a marshmallow to one of her students challenging him/her to just hold on to it for about 10 minutes and not eat it. If the student managed to hold on and not ingest the marshmallow then the student would get another extra marshmallow. The teacher then ups the reward to two marshmallows more if the student manages to not eat any of the two marshmallows already in their possession.

My own twist in this game is instead of handing one of my students a marshmallow and challenging him/her to not eat it, I would give the student a fun sized M&M’s baggy and challenge him/her with that particular candy. I would then tell my student if he/her manages to not eat the baggy of M&M’s for a minute I would give them another baggy at the end of the minute. While I’m waiting for this minute to be over I would instruct half of the class to give a 30 second argument of why he/she should eat the chocolate right then and there. Then I’ll instruct the other half of the class to make an argument against eating the chocolate for 30 seconds, making the choice for him/her even more difficult. If the student manages to not eat the M&M’s then I will hand him the other baggy of chocolates as promised, then ask the student to wait another minute and not eat the candy’s and this time he/she will get 2 more baggies. What I hope the students are taking from this activity is that they see the connection between waiting a period of time to get more of the desired item. I would explain at the end of the activity that compound interest works in similar ways. When you decided to leave some money untouched in a savings account for a certain amount of time, the compensation for leaving your money alone will be making more money overtime.

How did people’s conception of this topic change over time?

There has been a 360 degree change in the way we view compound interest today than how people/communities viewed it long time ago. There has been evidence in texts from the Christian and Islamic faith that talk about how compound interest is a sin or a usury. Back then the people thought if you lend money to a person there should be no interest being added to the loan because that would not be morally right to do to someone in need. Things have changed drastically since those times. We consider someone “smart” or being successful if you earn an interest in whatever it is they are doing. There was also talk about a Roman law where having interest on a loan was illegal. I believe many people changed their view or simply saw compound interest rate as something that would be beneficial financially because of what Albert Einstein once said. There’s speculation that he said “Compound Interest is the eighth wonder of the world. He who understands it, earns it…he who doesn’t….pays it.”

![]() How has this topic appeared in pop culture (movies, TV, current music, video games, etc.)?

How has this topic appeared in pop culture (movies, TV, current music, video games, etc.)?

While searching online about compound interest I ran upon a really cool video clip from one of the episodes from the animated T.V show Futurama. In this video clip it talks about Fry, the main character in the T.V show, trying to find out how much money he has in his bank account after being accidently frozen for 1,000 years. The video clip itself is pretty interesting and funny so I believe it would capture the kiddo’s attention. I would probably start with this video the following class day after starting the compound interest lesson. Before showing the video clip to my students, I would explain to them the situation that Fry is in and will ask my kiddos to make a guess of how much money he has in his bank account just by letting them know he was frozen for 1,000 years. I would then proceed to show them the video clip and leave out the part where the lady say’s the amount of money currently in his bank account and have the kiddos calculate the amount themselves with the given principal, interest rate, and amount of time. After giving the kids 2 minutes I would reveal the answer by playing the full video.

References:

“The Marshmallow Game” https://blog.kasasa.com/2016/04/marshmallow-game-compound-interest/

“Usury: a Universal Sin” http://www.giveshare.org/BibleStudy/050.usury.html

“Albert Einstein” https://www.goodreads.com/quotes/76863-compound-interest-is-the-eighth-wonder-of-the-world-he

Futurama; http://threeacts.mrmeyer.com/frysbank/

In my capstone class for future secondary math teachers, I ask my students to come up with ideas for engaging their students with different topics in the secondary mathematics curriculum. In other words, the point of the assignment was not to devise a full-blown lesson plan on this topic. Instead, I asked my students to think about three different ways of getting their students interested in the topic in the first place.

I plan to share some of the best of these ideas on this blog (after asking my students’ permission, of course).

This student submission comes from my former student Jillian Greene. Her topic, from Precalculus: introducing the number e.

How does this topic extend what your students should have learned in previous courses?

By this point in their mathematics career, the students have had plenty of experience with simple and compound interest formulas. Whether or not they discovered it them themselves through exploration in a class or their teacher just gave it to them, they’ve used it before. Now we can do an exploration activity that will connect that formula to the number e, and then to the limit. The activity will say: what if you invested $1 for 1 year at 100% compound interest? It’s a pretty good deal! But how much does the number of compounding periods affect the final value? Using the formula they have, A=P(1+r/n)^nt, they will calculate how much money they will make if it’s compounded:

The first time it’s compounded, the final value will be $2. However, the more compounding periods you add, the closer to e you’ll get. For instance, weekly would be A=1(1+1/52)^52=2.69259695. Every second will get you A=1(1+1/31536000)^31536000=2.71828162, which is pretty to 2.718. The last three calculations will actually begin with 2.718. We can have some discussion with this as a class, bringing in the concept of limits. Then we can assess and see if anyone has seen this number before. If not, they can pop out their calculators and you can have them type “e” and then hit enter, and blow their minds.

What interesting things can you say about the people who contributed to the discovery and/or the development of this topic?

Though Euler does not receive credit for the first discovery of the number e, he does receive credit for naming it and first publishing it. Some say the e means exponential, some say he’d already published uses for a-d, and some say he named it after himself. He is quoted directly for saying “For the number whose logarithm is unity, let e be written, which is 2,7182817… [sic] whose logarithm according to Vlacq is 0,4342944… “ regarding the number e. He also has a couple of other choice quotes that illustrate his humor, ie “[upon losing the use of his right eye] ‘Now I will have less distraction.’” And “”Sir,

hence God exists; reply!” In response to the French philosophe Diderot, who was trying to convert the court of Catherine the Great of Russia to atheism. Diderot had no idea what Euler was talking about and left the court to a chorus of laughter.” Back to e, however. If Euler did not first discover it, who did? A man name John Napier did the best he could to discover e. Napier was alive from 1550-1617, so he did not have access to a rich history of advanced algebra. Logarithm tables existed, some close to natural log, but none to identify this mystical number. Napier was merely trying to find an easier way to approach multiplication (and consequently exponentiation). His work, Construction of the Marvelous Rule of Logarithms, he states that X=Nap log y, where Nap log (107)=0. In today’s terms, with today’s math, we can translate that to Nap log y = 107 log1/e(y/107).

How has this topic appeared in high culture (art, classical music, theatre, poetry* etc.)?

After some discussion on this topic, if my class is a pre-AP or particularly curious class, I will have them go around and read this poem about e out loud. Then from this poem, I can have the students split up into groups. Each group will be responsible for dissecting this poem for certain things and then presenting their most interesting/exciting/relatable findings. One group will tackle the names; what history lesson is given to us here? Another group will handle applications; what did the various figures say we can do with e? The final group will report back on different representations of e; what all is e equal to? My expectations here would be for the students to see the insanely vast history and application of this number and gain some appreciation. I would expect to see Napier, Euler, and Leibniz for sure from the first group. From the second group, I would expect continuous compound interest, 1/e in probability and statistics, and calculus. The third group would be expected to present the numerical value of e, the limit that e is equal to, its infinite sum representation, and Euler’s identity. A number worthy of a 500 word poem and a slew of historical mathematicians must be important.

The Enigmatic Number e

by Sarah Glaz

It ambushed Napier at Gartness,

like a swashbuckling pirate

leaping from the base.

He felt its power, but never realized its nature.

e‘s first appearance in disguise—a tabular array

of values of ln, was logged in an appendix

to Napier‘s posthumous publication.

Oughtred, inventor of the circular slide rule,

still ignorant of e‘s true role,

performed the calculations.

A hundred thirteen years the hit and run goes on.

There and not there—elusive e,

escape artist and trickster,

weaves in and out of minds and computations:

Saint-Vincent caught a glimpse of it under rectangular hyperbolas;

Huygens mistook its rising trace for logarithmic curve;

Nicolaus Mercator described its log as natural

without accounting for its base;

Jacob Bernoulli, compounding interest continuously,

came close, yet failed to recognize its face;

and Leibniz grasped it hiding in the maze of calculus,

natural basis for comprehending change—but

misidentified as b.

The name was first recorded in a letter

Euler sent Goldbach in November 1731:

“e denontat hic numerum, cujus logarithmus hyperbolicus est=1.”

Since a was taken, and Euler

was partial to vowels,

e rushed to make a claim—the next in line.

We sometimes call e Euler‘s Number: he knew

e in its infancy as 2.718281828459045235.

On Wednesday, 6th of May, 2009,

e revealed itself to Kondo and Pagliarulo,

digit by digit, to 200,000,000,000 decimal places.

It found a new digital game to play.

In retrospect, following Euler‘s naming,

e lifted its black mask and showed its limit:

e=limn→∞(1+1n)ne=limn→∞(1+1n)n

Bernoulli‘s compounded interest for an investment of one.

Its reciprocal gave Bernoulli many trials,

from gambling at the slot machines to deranged parties

where nameless gentlemen check hats with butlers at the door,

and when they leave, e‘s reciprocal hands each a stranger’s hat.

In gratitude to Euler, e showed a serious side,

infinite sum representation:

e=∑n=0∞1n!=10!+11!+12!+13!+⋯e=∑n=0∞1n!=10!+11!+12!+13!+⋯

For Euler‘s eyes alone, e fanned the peacock tail of

e−12e−12’s continued fraction expansion,

displaying patterns that confirmed

its own irrationality.

A century passed till e—through Hermite‘s pen,

was proved to be a transcendental number.

But to this day it teases us with

speculations about ee.

e‘s abstract beauty casts a glow on Euler’s Identity:

eið + 1 = 0,

the elegant, mysterious equation,

where waltzing arm in arm with i and π,

e flirts with complex numbers and roots of unity.

We meet e nowadays in functional high places

of Calculus, Differential Equations, Probability, Number Theory,

and other ancient realms:

y = ex

e is the base of the unique exponential function

whose derivative is equal to itself.

The more things change the more they stay the same.

e gathers gravitas as solid under integration,

∫exdx=ex+c∫exdx=ex+c

a constant c is the mere difference;

and often e makes guest appearances in Taylor series expansions.

And now and then e stars in published poetry—

honors and administrative duties multiply with age.

References:

http://www.maa.org/publications/periodicals/convergence/napiers-e-napier

http://www-history.mcs.st-and.ac.uk/HistTopics/e.html

In my capstone class for future secondary math teachers, I ask my students to come up with ideas for engaging their students with different topics in the secondary mathematics curriculum. In other words, the point of the assignment was not to devise a full-blown lesson plan on this topic. Instead, I asked my students to think about three different ways of getting their students interested in the topic in the first place.

I plan to share some of the best of these ideas on this blog (after asking my students’ permission, of course).

This student submission comes from my former student Loc Nguyen. His topic, from Precalculus: introducing the number .

How could you as a teacher create an activity or project that involves your topic?

To be able to understand where the number e is produced in the first place, students need to understand how compound interest is calculated. Before introducing the number e, I will definitely create an activity for the students to work on so that they can eventually find the formula for compounding interest based on the patterns they produce throughout the process. The compound interest formula is F=P(1+r/n)nt. From this formula, I will again provide students a worksheet to work on. In this worksheet, I will let P=1, r=100%, t=1, then the compound interest formula will be F=(1+1/n)n. Now students will compute the final value from yearly to secondly.

When they do all the computation, they will see all the decimal places of the final value lining up as n gets big. And finally, they will see that the final value gets to the fixed value as n goes to infinity. That number is e=2.71828162….,

How has this topic appeared in the news?

To help the students realize how important number e is, I would engage them with the real life examples or applications. There were some news that incorporated exponential curves. First, I will show the students the news about how fast deadly disease Ebola will grow through this link http://www.npr.org/sections/goatsandsoda/2014/09/18/349341606/why-the-math-of-the-ebola-epidemic-is-so-scary. The students will eventually see how exponential curve comes into play. After that I will provide them this link, http://cleantechnica.com/2014/07/22/exponential-growth-global-solar-pv-production-installation/, in this link, the article talked about the global population rate and it provided the scientific evidence that showed the data collected represent the exponential curve. Up to this point, I will show the students that the population growth model is:

Those examples above was about the growth. For the next example, I will ask the students that how the scientists figured out the age of the earth. In this link, http://earthsky.org/earth/how-old-is-the-earth, the students will learn that the scientists used Modern radiometric dating methods to calculate the age of earth. At this time, I will show them radioactive decay formula and explain to them that this formula is used to determine the lives of the substances such as rocks:

How can technology (YouTube, Khan Academy [khanacademy.org], Vi Hart, Geometers Sketchpad, graphing calculators, etc.) be used to effectively engage students with this topic?

To introduce to the students what the number e is, I will engage them with two videos. In the first video, https://www.youtube.com/watch?v=UFgod5tmLYY, the math song “e a magic number” will engage the students why it is a magic number. While watching this clip, the students will be able to learn the history of e. Also the students will see many mathematical formulas and expressions that contain e. This will give them a heads up that they will see these in future when they take higher level math. It is also pretty humorous of how Dr. Chris Tisdell sang the song.

In the second video, https://www.youtube.com/watch?v=b-MZumdfbt8, it explained why e is everywhere. The video used probability and exponential function to illustrate the usefulness of e, and showed how e is involving in everything. It gave many examples of e such as population, finance… Also the video illustrates the characteristics of the number e and the function that has e in it. Watching these videos will enhance students’ perception and understanding on the number e, and help them to see how important this number is.

Reference

https://www.youtube.com/watch?v=b-MZumdfbt8

https://www.youtube.com/watch?v=UFgod5tmLYY

http://www.math.unt.edu/~baf0018/courses/handouts/exponentialnotes.pdf

http://cleantechnica.com/2014/07/22/exponential-growth-global-solar-pv-production-installation/

http://earthsky.org/earth/how-old-is-the-earth